Mandatory e-invoicing

for all B2B transactions

The French government announced in 2019 that e-invoicing would become mandatory for all domestic B2B transactions starting in 2024. This regulation is part of the government’s effort to tackle tax fraud by seamlessly transmitting all transaction data to its tax authority.

Companies will no longer be able to send invoices directly to their customers, going instead through a government or private third-party platform. This mandate will gradually be applied between July 1, 2024, and January 1, 2026, depending on company size. All companies must understand these regulations and how to prepare for compliance.

The French Finance Law has four main objectives:

- Boost competitiveness

- Combat VAT fraud

- Increase business efficiency

- Simplify VAT returns

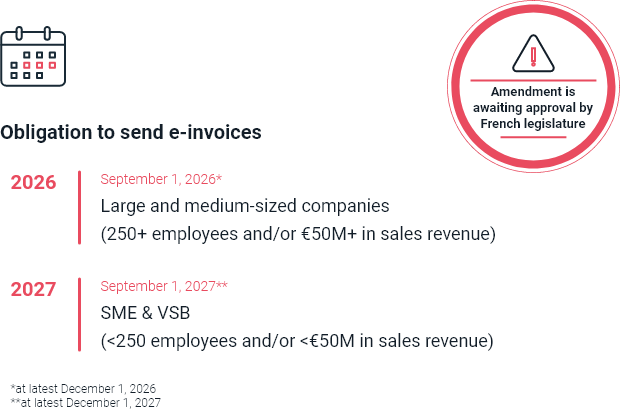

Implementation schedule

Article 153 of 2020 French Finance Law makes B2B e-invoicing mandatory for all companies subject to Value Added Tax (VAT) in France. As of July 1, 2024, all companies, regardless of size, will be obligated to receive e-invoices. And progressively, depending on company size, all companies will be obligated to send e-invoices by January 1, 2026. All transactions will have to go through Chorus Pro, the government public invoicing platform (PPF*) or a registered private provider (PDP**), validated by the French tax authority as an authorized platform.

*PPF: Portail public de facturation

**PDP: Platforme de dématérialisation partenaire

E-invoicing & e-reporting

Making sense of it all

There are two components to the reform: e-invoicing and e-reporting. As mentioned above, e-invoices and e-reporting data can be submitted directly to Chorus Pro or through a third-party solution of a registered private provider. France’s General Directorate of Public Finance (DGFIP) refers to this two-option approach as the “Y” model, which allows registered private platforms to transmit e-invoices to recipients without passing through Chorus Pro. However, registered platforms must extract and transmit invoice data to the public invoicing portal simultaneously.

There are three available transmission options in the “Y” e-invoice exchange model:

Both parties use the public invoicing portal, Chorus Pro

Only one of the two parties (supplier or buyer) uses a private registered platform

Both parties use a private registered platform of their choice.

The DGFiP selected this model because it offers more flexibility by allowing companies to choose the e-invoicing technology provider of their choice while also conforming to the new government regulations.

E-invoicing

Optimize invoice management by enabling processing in any format and from any input channel, whether invoices are received by mail, email, fax, or EDI. By turning a machine-readable EDI invoice into a human-readable version, you can now apply standard AP processes to EDI invoices as well.

E-reporting

E-Invoicing will not be mandatory for B2C and cross-border invoices. E-reporting is the obligation to transmit invoicing and payment data for transactions carried out electronically within France by individuals (B2C) or foreign operators (international transactions). E-reporting obligations will follow the same calendar as e-invoicing. The main objective of e-reporting regulations is fraud detection.

Preparing your company

for B2B e-invoicing

There's a lot to navigate when it comes to ensuring compliance. Beyond understanding the different e-invoicing regulations, you want to make sure you avoid financial penalties. At €15 per invoice and €250 per non-compliant transmission, the fines can quickly accumulate and impact your bottom line.

Don’t get caught playing catch-up. Here are some helpful tips you can already get started on to ensure that your company is ready for July 1, 2024, and beyond!

Anticipate the impact on your IT systems

Collect all mandatory information necessary for all tax authority exchanges (domestic B2B e-invoicing, international B2B and B2C e-reporting). You must also select your platform for e-invoice transmission and reception.

Optimize your current invoicing exchanges

Choose one solution for all your current and future needs, including: domestic B2B exchanges via Chorus Pro, international B2B and B2C exchanges, e-reporting via Chorus and sending invoices worldwide (in both paper and e-invoicing format).

Avoid bottlenecks

Everyone is up against the same deadlines and certified private providers will soon be inundated with requests and workloads. Don’t be at the mercy of your provider’s availability! Make sure you are up to speed on the latest reform updates and existing solutions. Anticipate solution implementation and user training, and carefully coordinate your project internally.

Maintain good relationships

Closely monitor and maintain relationships with the tax authorities, your customers (who expect you to be in compliance in order to pay you), and your suppliers (who will know that you have received the invoice and expect you to pay on time).

Benefits of using a PDP

for e-invoicing

A registered private provider (PDP) transforms, validates and sends invoices to the French tax authority, as well as reports the invoicing data required for e-reporting to the PPF (Chorus Pro-based portal). PDPs are the only ones that can exchange invoices directly and not go through Chorus Pro.

Acting as an intermediary between companies and the tax authorities, PDPs play a key role in the digitization of invoicing and accounting processes, including:

- Facilitating the transition to the e-invoicing reform

- Ensuring compliance

- Supporting businesses in the digitization of invoice

processing, both sending and receiving - Transmitting invoices to Chorus Pro in one of the structured formats

- Performing invoice controls, extracting required data, handling e-reporting,

retrieving the status of transmissions, etc.

The digitization of invoicing processes has significant benefits for businesses and governments. It reduces paperwork, eliminates errors and delays, and saves time and resources. It also improves compliance with tax regulations and enhances transparency and accountability. The role of PDPs is critical in achieving this goal, as they provide a bridge between businesses and the PPF.

Why Esker

- Key player in the French invoicing market and present internationally through 15 subsidiaries

- Global leader in automated source-to-pay and order-to-cash solutions, helping companies digitize their invoice processing, both inbound and outbound

- 38 years of experience with 20+ years focused on cloud solutions

- Global compliance in over 60 countries

- Platform ISO 27001 certification

- Actively participates in consultation workshops led by the DGFiP to remain updated on industry evolutions and provide up-to-date information to its customers

- Active member of the Forum National de la Facture Electronique et des Marchés Publics Electroniques (FNFE-MPE), which promotes the use of e-invoicing in France and helps Esker keep up with regulatory changes in invoicing

- Solutions connected to different government platforms (Chorus Pro, SDI in Italy, FACe in Spain, etc,) and interoperability networks including PEPPOL

- Committed to obtaining registration by the tax authorities as a PDP and focused on offering a global solution that complies with the regulations governing e-invoicing and e-reporting

Nuestros partners

- Coming Soon